It's common knowledge that only a handful of business families continue beyond the third generation as a family with a shared enterprise. How can younger families prepare to join that exclusive club? To gain insights into this question, our research team interviewed members of 100 large, global families. We call these families “generative” because they have succeeded beyond their third generation as both a thriving business and a connected family. A generative family is more than the owners of a successful business — they continually create both financial and non-financial wealth across generations.

After the first generation, these families shifted their attention from creating new wealth (although this was still important) to building and sustaining a great family. They became more attuned to creating non-financial “wealth” through personal relationships, the skills and capabilities of their children, and shared activities that sustain their community and environment.

By investing in family relationships and family activities, they created a legacy, building a strong and productive family culture and developing the capability and commitment of rising generations. While they value family building as positive in itself, they report that development of a strong, aligned, caring and well-organized family also helped them extend their business and financial wealth.

Family building occurs naturally when a nuclear family lives together. A household is a safe refuge, where kids can learn and grow and where family members care for and trust each other. By the third generation, the family has expanded into multiple households, with increasing diversity of interests, talents and goals. To succeed, each new family generation must reaffirm their shared values and mission and develop a cadre of leaders to extend family wealth. As family branches grow and disperse, owning an ever-changing portfolio of business and financial assets, it becomes a huge challenge to preserve the special features of an intimate, interdependent family.

The great dynasties of recent centuries — the ÂRothschilds and Rockefellers — offer some models. The Rothschilds leveraged their family bonds for cross-national collaboration and internal family communication and trust to create a global banking and financial empire. The family became one of the first global intelligence networks, sought by national leaders. The Rockefellers, with the largest family fortune of the last century, continue today as a philanthropic and investment family. Generations ago, the Rockefellers began to meet as a cross-generational family and develop an internal family culture of social responsibility, with many shared investments and projects.

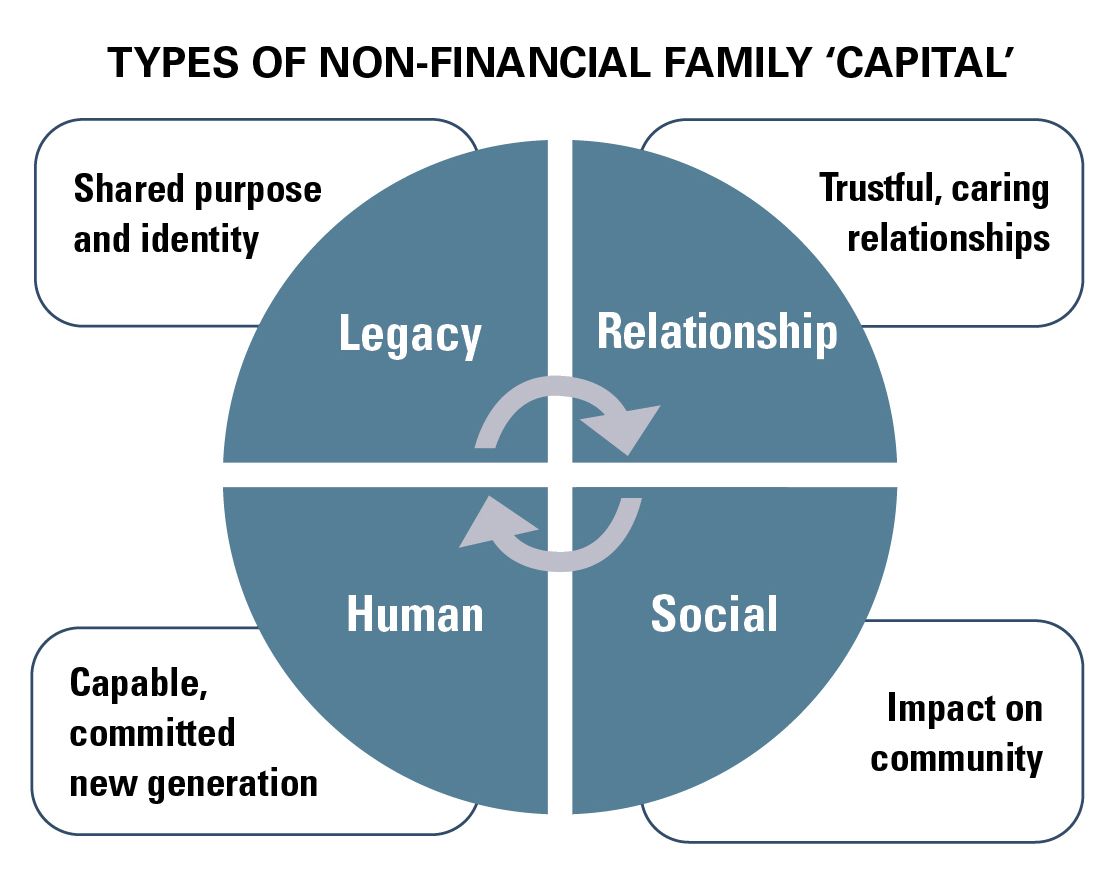

The generative families in our study combined the best features of business and family, pursuing the following four paths, each of which relates to a different form of “non-financial” family capital:

Great business families actively commit to an agenda of intentional activities to develop each of these paths.

Path 1: Aligning identity around shared purpose and values

Generative families share more than ownership of profitable investments. They are united by a shared purpose, financial and non-financial goals and a long-term desire to pass their entity across generations. They need to affirm a shared purpose and long-term perspective to continue as a shared enterprise across generations. As a fifth-generation member of the Hermès family noted: “You don’t inherit a family business; you borrow it from your grandchildren.” This defines the concept of stewardship, in which an owner can enjoy the wealth, but with a responsibility to pass it on to the next generation in stronger shape.

As families grow into a new generation, they might ask: “Who are we, and what do we want from our wealth?” This inquiry engages the whole family, which needs shared purpose to avoid drifting apart. The legacy of the founders is inspiring but is not enough. Each new generation needs a reason to remain together into the future. They find it beneficial to develop a set of family values and forge a new path.

By the second generation, each of the families in our research began to ask each other whether they wanted to remain together as a shared family enterprise and what they wanted to do together:

• “We asked each other, ‘Do we want to work together in a family business?’ And there was a unanimous yes. So we set a vision of what we wanted to achieve together, why we thought there was benefit and what the negatives were.”

• “The first 80 years were basically surviving and building up wealth. With more wealth, there could be a change in behavior, so we have to be conscious about how this wealth is deployed and how we manage to keep our values.”

This is not a task for the older generation alone, or the business leader. Each new individual who joins the family has personal values and life goals; these must be shared and balanced with the legacy values, to create a path forward for each new generation. This process reportedly takes time, energy and inclusion of all members of the family.

Path 2: Building personal relationships in a working family entity

Mission and values do nothing for a family unless they are implemented and have a positive impact. Building upon shared values, a generative business family actively develops caring, trusting relationships with the younger generation, including far-flung members, to establish an engaged and active family organization. It has productive get-togethers, celebrates the family legacy and history, maintains shared vacation properties and other real estate, develops new businesses, manages conflict and engages in community service. These aspirations need more than good intentions; they require organization, resources, planning and commitment. These non-business activities can be realized only through an organized family structure.

Generative families have regular business and financial gatherings, but they also gather regularly as a family. They have annual family assemblies — inclusive, multiday gatherings where the whole family gets together and engages in relationship building.

Family organization begins by building personal relationships among the widespread family members. If they do not maintain personal relationships and connection, they may be a business but not a family. Generative families realize that to remain vital, the family must invest in knowing and caring about each other. When together, they build family values and culture and create opportunities to bond as a family.

The families report that a majority of the family attends their retreats, not because they have to, but because they want to:

• “What encourages everyone to come to our annual retreat is our children making relationships with their cousins. So, by the time they get into the boardroom or family council, they have relationships with each other.”

• “When my daughter and her husband, who are fourth generation, hosted our annual gathering for the teenagers, they had 15 teenagers show up — and they're instantly friends.”

In order to transfer their values and commitment across generations, the business family develops a parallel organization to take care of family matters alongside their business and financial governance. Family members select an organizational and leadership team for their family, who are different from the business leaders. This leadership team, often called a family council, helps organize the family's many activities. They resolve conflict and develop policies and procedures that respect each individual, not just the major owners and shareholders.

The family is more than the business, but the business is the family's fuel and foundation. In succeeding generations, members change from hands-on owner/operators to stewards, hiring non-family leaders for the company and taking on oversight and transmission of their values to the business. They are not just looking for a business successor, but rather preparing everyone in all generations to take productive and active roles in family affairs.

Family enterprise leaders and trustees are often reluctant to share information about the business with family beneficiaries. They “take care” of the rising generation but do not feel the need to inform them. This paternalistic model is common, but the family members we interviewed found this tradition did not allow for the development and engagement of the next generation. Without being informed, how can they learn about the legacy and prepare themselves for possible employment in the business?

To develop a family organization, important guidelines include providing information (with invitation to comment) and sharing ideas. As a family leader stated, “It's critical to our success that communication channels with family members remain transparent in both directions. That's how we ensure there's trust, harmony, and support from the family.” Inclusiveness is a core aspect of building relationships. Opportunities are created for family members who live far away or pursue independent careers to get to know each other. Those who are not full owners are encouraged to participate in family activities.

All of our generative families hold some variant of an annual business meeting, where family members are invited to attend and learn from the business and financial leaders. These events can be traditional one- or two-hour presentations of numbers and charts, but many families find ways to make them more interactive. One family with a large business produced “a very detailed annual report, not unlike that of a public company.” Activities can include visits to the family business or foundation, conversations with key employees and tours of company plants.

Path 3: Developing human capital of the rising generation

A great business family's main “product” is its rising generation. The family wants to see their children become capable, responsible adults who care about each other, share the family values and are ready to take on stewardship of family enterprises. The elders can't ensure that every heir will turn out as they'd wish, but they invest in activities that make this outcome likely:

• “People don't understand the importance of education and underestimate the time, care, and devotion it takes to build a strong family. Our family business is a combination of individuation and collectivism.”

• “The important matters include what we expect heirs to do, values for parents to instill in their kids and access to foundation programs. We have community projects, sending some kids to do hospital work or to Habitat for Humanity, to give them a flavor of the business stuff we think is important.”

The families in our study identified values and qualities they encourage in their children:

• Generosity: Give back to the community.

• Respect: Value people of all wealth backgrounds.

• Work ethic and skills: Develop the capability to earn their own money and find work at which they can succeed.

• Self-esteem: Find value in themselves independent of their wealth.

• Financial literacy: Handle money wisely.

• Responsibility for wealth: Understand wealth as a tool, not an end in itself.

• Frugality: Spend prudently.

• Appreciation: Value the opportunity wealth offers.

Generative families also create educational and skill-development programs for the rising generation. These go beyond information sharing to develop the new generation's capability to take on leadership in the family enterprise. They teach relationship, financial and business skills — not skills that are necessarily taught in higher education.

Family business education is not simply “delivered” to the youngsters. It combines active engagement from them and leadership from the elders, as this elder observes: “It's essential to have a commitment to family education. In the early days, we held workshops on understanding personality types, communication skills and financial things. Utilizing an outside source to provide programming makes a huge difference, because developing things on a one-off basis is incredibly time-consuming.”

In these family education programs, the young members learn to work effectively as a team, overcoming rivalry:

“We have done age-appropriate work with the young generation, including self-development, leadership, understanding self, and basic entrepreneurial practices. We review every acquisition we've conducted and review our financials twice a year with them. They've gone through our tax returns in detail and been to such things as product launches, grand openings and site expansions. If they want to have a car [when they turn 16], they have to make $5,000 on their own by, say, lifeguarding or cutting grass. We've also designed a summer experience for teenagers where they spend time in finance, IT, strategic planning, human resources and small-business initiatives.”

Mentoring is the pairing of a young family member with a trusted senior person (a family member, independent board member or non-family executive) who helps them develop skills to work in the family business, and to whom they can confidentially open up about their anxieties. Young family members are often encouraged to get hands-on experience in the business, as this family council leader reports about their fourth-generation members:

“Our G4 are juniors or seniors in high school, ready for summer jobs and internships. We create opportunities for them to work in the business at age 15. We also focus on educating our G4s about the business, what they're a part of and what they've been born into, along with talking about wealth and stewardship.”

Mentoring and career development serve a dual purpose for qualified family members, helping them prepare for their career of choice or part-time governance roles. Being part of these efforts offers the rising generation visible opportunities to add to the family's social and business mission and demonstrate their leadership abilities.

Since they are to become the keepers of the legacy, the younger generation must learn the skills and responsibilities to lead the family for the future.

Path 4: Recognizing the responsibility to give back

Once a family has been wealthy and successful for a long time, working for the family business may not have great allure for young family members, who have many other wonderful career options. So how does a family achieve their active engagement and commitment? One way is to appeal to their sense of social justice.

The family's values can be expressed through philanthropy, corporate social responsibility and impact investing. These activities offer a path for the family to work across generations while serving others; they can even furnish career options for young family members. If this is missing, many members of the younger generation may fall away from each other.

A common theme among our generative families was gratitude and responsibility to give back. Ginny Esposito, founder and former president of the National Center for Family Philanthropy, notes, “It all starts with a sense of gratitude. They feel there have been blessings and gifts they've received. They're grateful for those gifts, they're grateful for those who made them possible, and they want to give back.”

As one generative family member puts it: “We offer a decent job to more than 1,000 employees on our farm and help their families put food on the table. To make our surrounding community healthier and more secure, we are constantly looking for innovative ideas to give back to them and decrease the unemployed poor.”

Working together as a family to do good, particularly in one's community, becomes a powerful win-win, benefiting not only those to whom the service is directed but also the family as a whole. It deepens family relationships and brings families the joy of making a positive difference in the world. This is particularly impactful for the rising generation, giving them a sense of their ability to effect positive change in the world.

Some families go on service vacations, offering help in community projects. One family recalls a trip to China with some as young as pre-teens. It was a trip that became a touchstone learning for the family, helping them define a global focus for their philanthropy.

An essential investment

Our research found that successful generative families who survive beyond their third generation attend to the care and development of their family and their business. They consider this internal investment one of the most important ways to use their wealth. While business savvy and adaptability are important, these families view the foundation of future success as lying in their extended family and non-financial capital, including the development of the character, capability and commitment of each new generation.

Dennis T. Jaffe, Ph.D., is an adviser to families focusing on family business, governance, wealth and philanthropy. This article presents insights reported in his book Borrowed from Your Grandchildren: The Evolution of 100-Year Family Enterprises (Wiley, 2020).

Copyright 2021 by Family Business Magazine. This article may not be posted online or reproduced in any form, including photocopy, without permission from the publisher. For reprint information, contact bwenger@familybusinessmagazine.com.