As a result of the market dislocation brought on by the COVID-19 pandemic, many private family-owned businesses find themselves in a precarious situation with budgets stressed and a seemingly never-ending battle to find suitable sources of capital. Family business owners who never expected to raise money outside the family are now faced with (1) extremely tight and expensive debt markets, (2) difficulty accessing new federal programs (some may have already exhausted limited PPP loans) and (3) potentially limited additional access to family capital or a reluctance to put additional capital into the business.

While some families look to potential acquirers as a solution to both de-lever family risk and raise capital for their businesses, many families are not ready or never intend to sell their businesses. Even if a family is willing to sell, there is a growing valuation disconnect between potential acquirers and sellers resulting from the impact of COVID-19 and other business, political and social uncertainties.

Of the many structures and approaches to marry up sources of capital with family businesses, minority/growth equity is well suited for today’s difficult markets. A growing number of families who previously sold their companies or otherwise have significant investable assets are looking to invest in private companies for the long term as opposed to investing in the public markets. These families are seeking companies that operate with a shared vision and values.

Family investors often focus on partnering with family businesses because both parties' needs and interests often match up well. The inherent flexibility family investors bring to their investing can be helpful to family businesses.

often match up well. The inherent flexibility family investors bring to their investing can be helpful to family businesses.

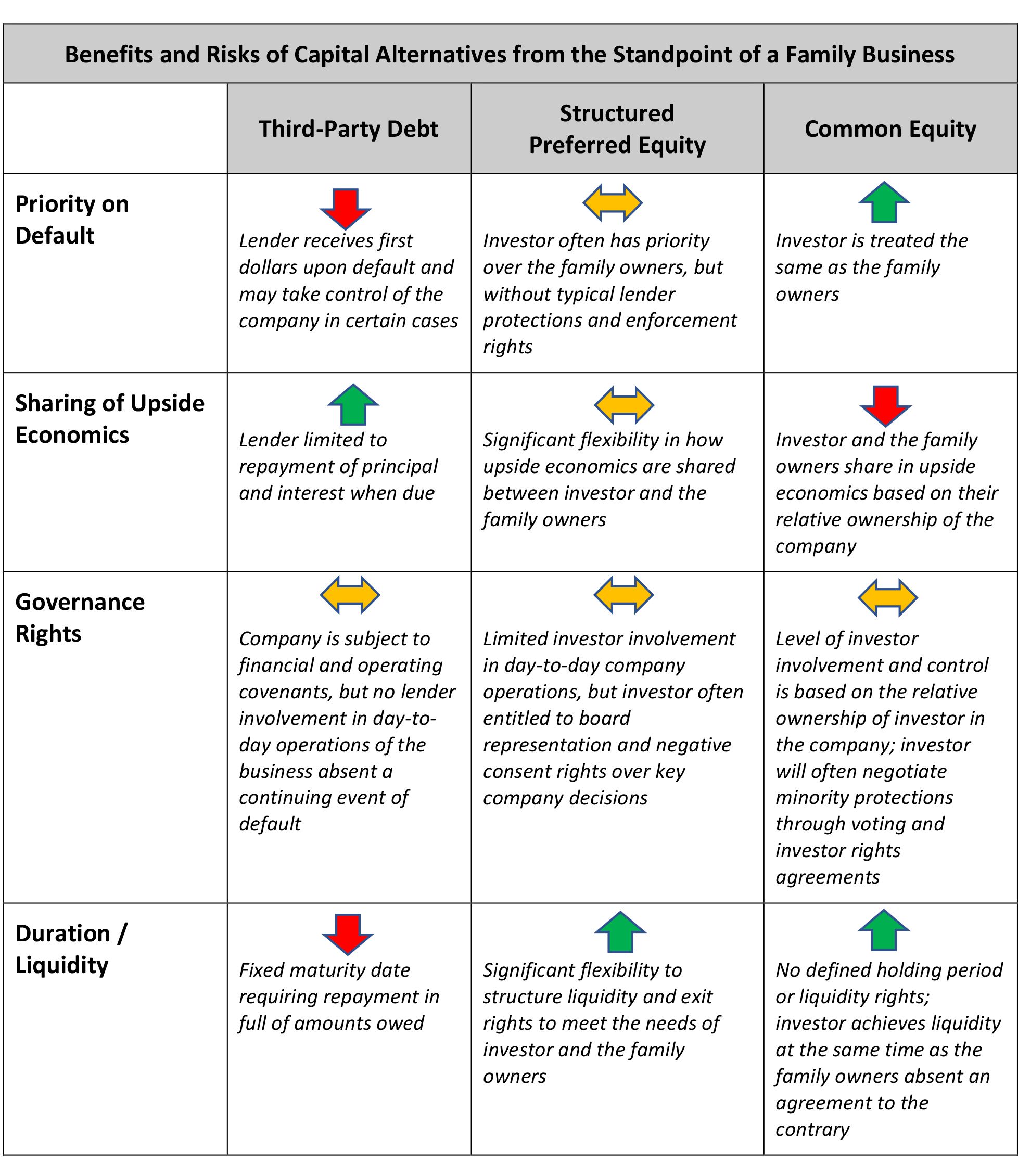

Minority/growth equity provides a business with the capital necessary to support and grow operations without the family owners giving up control (other than, in most cases, some limited negative controls afforded to the holders of preferred equity) while also limiting the dilution caused by artificially depressed valuations. This capital solution can be structured in multiple ways, including simple common equity, but often takes the form of structured preferred equity.

Features of structured preferred equity

Structured preferred equity can be highly bespoke. Typical characteristics of structured preferred equity include:

• Downside protection. Debt-like protection in the form of a liquidation preference over common equity (i.e., the preferred capital is first in line to receive a return of the invested amount in preference to the family’s and other equity holders’ common ownership), but without debt-like enforcement mechanisms, such as security interests, robust covenant compliance or foreclosure remedies.

• Preferred return. Interest in the form of a “yield” (e.g., 8% to 12% yield on principal investment, which may compound and may be paid-in-kind instead of paid in cash).

• Upside economics. Preferred equity may be “straight preferred” (receives priority return of capital and yield), “participating preferred” (receives return of capital and yield and participates with common equity on an as-converted basis) or “convertible preferred” (receives either a return of capital and yield or participates with common equity on an as-converted basis). Straight preferred is less common but usually most favorable to the family owners. Convertible preferred is less dilutive to the family owner than participating preferred and is usually the family owners' second choice. The type of preferred equity will often dictate the amount of yield payable on such preferred equity (i.e., straight preferred will have a higher yield than participating preferred).

• Governance. Representation on the company's board of directors and select negative control and minority protections, such as:

− Limitations on the business’s ability to incur debt, make capital expenditures inconsistent with the budget or complete material acquisitions, dispositions or investments

− Capital structure protection (e.g., anti-layering, restricted payments, organizational document amendments)

− Approval rights over equity redemptions and repurchases and affiliate or related party arrangements

− A voice in senior management hiring and firing decisions

− Information rights

• Liquidity. Exit or other liquidity rights at pre-determined dates (e.g., a right to cause the company to redeem the preferred equity after some agreed to period (e.g., five years) at a pre-determined or market valuation or a right to cause a sale or IPO of the company).

Sources of structured preferred equity

Sources of structured preferred equity include traditional private equity funds, privately held businesses with dedicated investment divisions, public and private pensions and family capital providers. Each source of capital has unique investment objectives and operational limitations. For example, while a traditional private equity firm may have flexibility in its investment mandate to make minority investments, these firms may still be faced with time limitations on their funds. Therefore, they may seek to realize liquidity on an investment earlier than, for example, a family capital provider.

While private equity investors have been very successful in supporting the next stage of growth for family-owned businesses, a growing number of family capital providers are entering the minority/growth equity market. Family capital providers have significant flexibility in structuring their investments. Family providers of structured preferred equity allow for flexible durations, structures and terms while bringing a unique perspective to working with family businesses given their sources of capital, the duration of their investing and their investment philosophies.

Choosing the right partner

When evaluating a potential source of minority capital, family business owners should consider multiple dimensions — not only the terms of the capital but also the suitability of the partner providing the capital. Given the negative controls, minority protections and liquidity rights attached to structured preferred equity, selecting the right partner is a critical consideration.

As discussed in detail above, the form of capital dictates the relative rights and obligations of the parties involved, but how those rights and obligations are exercised by the investor will determine actual outcomes for the business and its owners. Families should keep the following considerations in mind when selecting a partner:

• Does the partner share a common understanding of how businesses are built and operated, including how business decisions affect employees, business partners and the community?

• Does the partner understand family and founder dynamics, such as developing the next generation, creating robust succession plans and preserving legacies?

• Is there an appropriate alignment of values between the family and the partner? How will the partner behave when times are good? How do those behaviors change during tough times?

• Does the partner share the same investment horizon as the family? Specifically, will the partner look to force a sale of the family business or other liquidity event (e.g., will the partner “put” the preferred equity back to the company, which in practice forces a sale of the family business due to lack of alternatives to fund the put) prior to the family's preferred timing?

• To what extent does the partner require involvement in key operating and financial decisions, such as setting annual budgets, reinvesting in the business and pursuing acquisitions and divestitures? Is the level of partner involvement and authority commensurate with the value and expertise it provides?

• How flexible is the partner and its capital base? Can the partner step in with speed and certainty to provide additional, differentiated capital to execute on offensive or defensive strategies?

• Does the partner have the right strategy, the right team and the right resources to make good on its promises?

Similar to how capital providers perform detailed due diligence on prospective investment opportunities, family owners should apply the same rigor to selecting a partner. Owners should ask the right questions of the partner and its team to develop an informed understanding of how the partner operates and adds value. Owners should treat the selection process like an interview Find the “A” player that possesses the right attributes and competencies, in the right role, to achieve clearly defined objectives.

Despite cautionary tales to the contrary, past performance and behavior is often a good indicator of future results. Providers of family capital often share a common set of values and experiences with the family-owned businesses they look to invest in, making them particularly well-suited to partner with family business owners who care about preserving the family legacy and maintaining company culture.

During this period of market uncertainty, family business owners should consider all the tools available to maximize business continuity, wealth preservation and flexibility of liquidity. Preferred minority/growth equity structures are a useful mechanism to accomplish a number of objectives while retaining future flexibility.

Paul Carbone is president and managing partner and Brad West is general counsel and chief compliance officer of Pritzker Private Capital (ppcpartners.com). Ryan Harris, Cole Parker and Adam Wexner are partners at Kirkland & Ellis LLP. Harris leads the firm’s Private Investment & Family Office Practice (www.kirkland.com).