A competitive compensation plan is critical to attract and retain talent. As a family business evolves, it often recruits non-family employees who have the skills and experience to help the company grow and thrive. Key questions that arise are how much non-family managers should be paid and how should that pay be delivered.

Pay data is especially difficult to obtain for private companies given the lack of public disclosure. To illuminate pay practices at family businesses, Compensation Advisory Partners (CAP), an independent executive compensation consulting firm, joined with MLR Media to create our own Family Business Executive Compensation Survey. This exclusive study drew responses from over 300 respondents representing a wide range of industries and revenue sizes in 2021.

As an example…

To illustrate how an effective compensation package can be developed from the CAP-MLR Media survey, we present the hypothetical case study of Cousins Incorporated, a third-generation family-owned manufacturing company.

Some background on Cousins Inc: Cousins Incorporated generates $35 million in annual revenues and wants to expand its brand. It has decided to hire its first outside CEO — ideally, an executive who is knowledgeable about the industry and experienced at scaling a business. The board is deliberating on the compensation philosophy, pay levels and mix of salary and incentives (both short-term and long-term) for this role.

Compensation Philosophy: Where are we positioned against competitors?

A general pay philosophy establishes where Cousins Incorporated would like to position the CEO's pay relative to the market. In the past, the board has informally targeted pay around the median of industry peers. This means Cousins Incorporated is at the midpoint of the pay range among competitor companies. With the hiring of an outside CEO, the board would like to discuss and develop a formal compensation philosophy for the company.

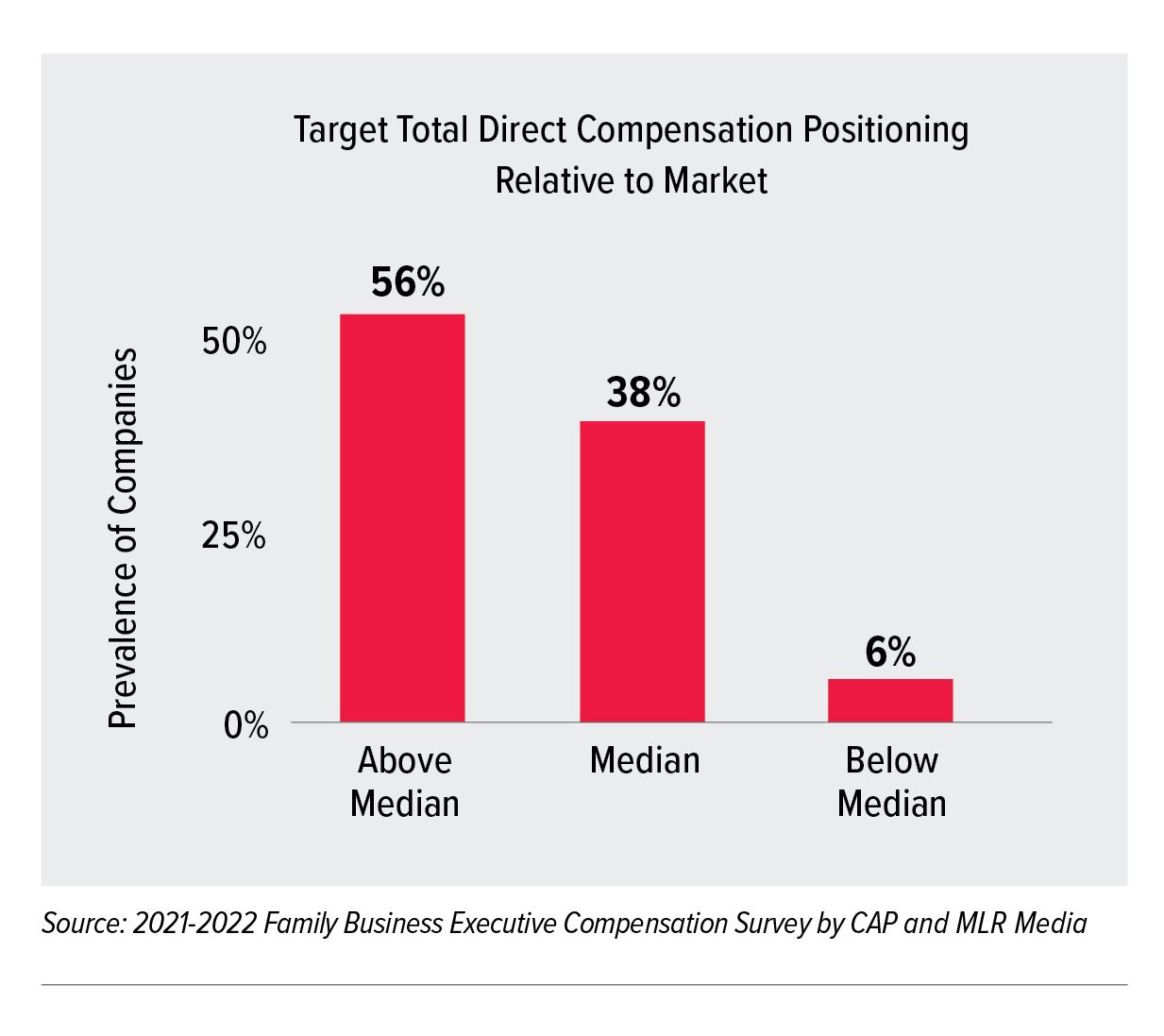

As the business and overall economy ramp up, the board expects heated competition for top talent. The CAP-MLR Media survey shows that more than half of family businesses target pay levels above the market median to attract and retain executives. Moreover, most companies expect to increase executive base salaries between 3% and 5% this year given cost-of-living increases. The chart below summarizes how family businesses position their pay relative to the market. It indicates that most family businesses (94%) are planning to pay total direct compensation (salary + bonus + long-term incentives) at the market median or above.

There are many reasons companies choose to pay above the market median. Above-median pay helps attract and retain candidates who have a rare skillset, high potential or many years of experience. In Cousins Incorporated's case, the board agrees to target above-median pay in order to find the right CEO candidate who fits with the company's culture and has a proven track record in scaling a business.

Compensation Levels Vary with Size

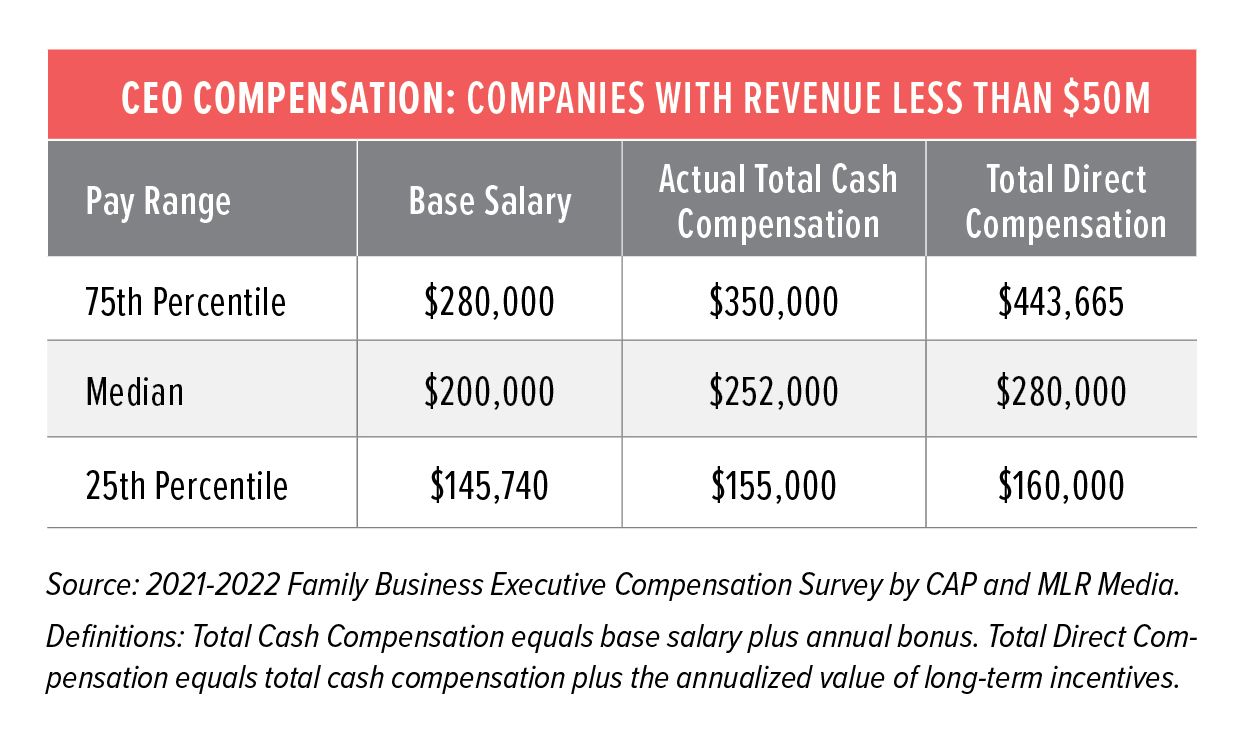

Company size is an important consideration in establishing compensation levels. It significantly affects the organizational complexity as well as executives' responsibilities. The survey shows that pay levels rise with increasing company size. The median CEO total direct compensation across the entire survey population is $425,000. However, for companies with revenue under $50 million (Cousins Incorporated's size), the median total direct compensation is $280,000. The following chart shows the pay range for CEOs at companies with revenues under $50 million.

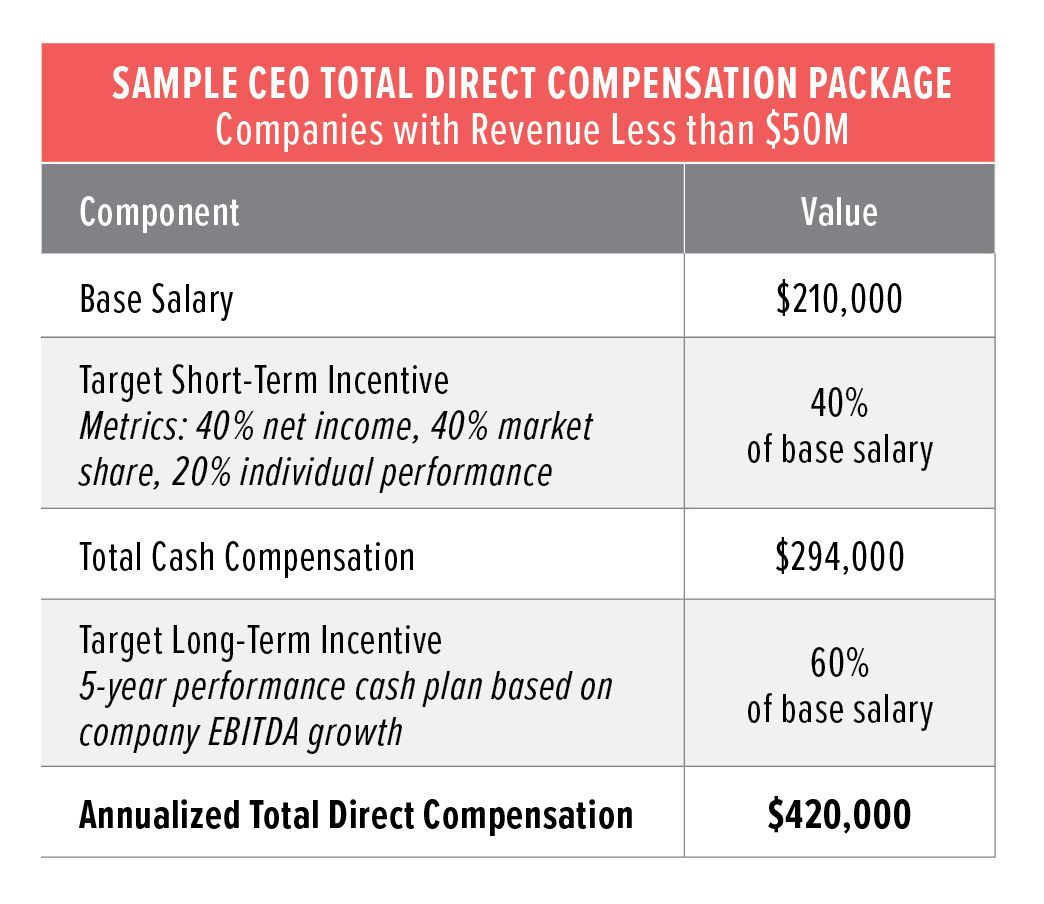

The board of Cousins Incorporated proceeds with a total direct compensation package of $420,000. This positions the company competitively between median and the 75th percentile of market (i.e., third quartile pay positioning). This level of pay will help the company access a talent pool with the specific skillset to meet its growth plan.

Paying for Performance Through Incentive Plans

Short- and long-term incentives are important tools for rewarding performance and focusing executives on the objectives of the business. Short-term incentives are designed to align with shareholders' interests in the near term, usually a year in duration, while long term incentives focus on the three- to five-year time horizon. Cousins Incorporated currently offers executives an annual incentive plan based on individual performance. Management and the board are concerned that the plan is too subjective and does not place enough emphasis on the company's financial objectives.

Short-Term Incentives

Short-term incentives are commonplace among family businesses, with 93% of respondents offering these incentives to their executives. Most companies use multiple metrics in their short-term incentive plans. The most prevalent are:

· Profitability measures (net income, operating income, etc.)

· Individual performance

· Operational objectives

Given that one of Cousins Incorporated's primary objectives in the coming years is growth, the board proposes that the new CEO's short-term incentive payout be based on net income, market share and individual performance.

Long-Term Incentives

Half of the family businesses surveyed have not developed a formal long-term incentive plan. Over at our fictitious company, Cousins Incorporated, the board decides to offer the candidate a cash plan spanning a five-year performance period. The board recognizes that a plan is needed to further incentivize the new CEO and align with shareholder growth goals.

A performance cash plan functions like a multi-year bonus by rewarding executives who meet predetermined goals with a cash payout at the end of the performance period. This is the most prevalent long-term incentive vehicle among family businesses, as it incentivizes value creation without diluting shareholder ownership.

Developing a Holistic Compensation Program

Like many family businesses, Cousins Incorporated finds the issue of compensation, especially at the executive level, difficult to navigate. Survey data together with thoughtful analysis can help keep the dialogue focused on the company's strategy and objectives. The CAP-MLR Media survey gives Cousins Incorporated a tool to deploy in current and future deliberations on compensation. The board has decided on the following compensation package for the CEO candidate:

Looking Ahead

Executive compensation is one of the most important business decisions facing family-owned businesses. The inaugural iteration of this CAP-MLR Media survey, conducted in 2020, offered a picture of how family businesses adjusted their pay practices to respond to pandemic-related disruptions. In subsequent survey iterations, we will continue to provide data on how companies managed the transition to normal operations. We hope this survey series can add ideas and insights to your family firm's approach to executive compensation. To participate in the next survey and receive the full data set, please contact David Shaw, MLR's publishing director, at dshaw@familybusinessmagazine.com.

Susan Schroeder and Bertha Masuda also contributed to this article.